Phoenix home buyers in the market for higher-end homes still have Jumbo mortgage options available in 2024. Although some higher loan-to-value options have tightened over the last year, buyers can still obtain 90% and even 95% financing under certain conditions.

Phoenix home buyers in the market for higher-end homes still have Jumbo mortgage options available in 2024. Although some higher loan-to-value options have tightened over the last year, buyers can still obtain 90% and even 95% financing under certain conditions.

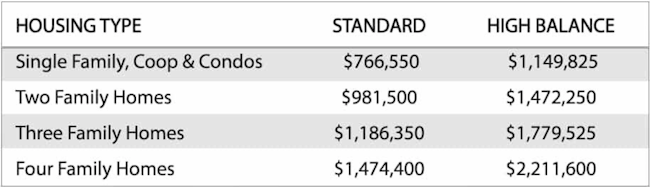

A jumbo mortgage is any loan that exceeds the Conforming Loan Limits. The current limit in Maricopa County and the rest of Arizona is $766,550 for a single one-unit home. Multi-unit properties have higher loan limits as seen in the chart below.

Maximum Baseline Loan Amount for 2024:

Historically, jumbo lenders have asked for at least a 20% down payment or even 25% in some cases depending upon the amount borrowed. Minimum down payments can also vary slightly from one lender to another and can be affected by credit scores or the type of property being financed.

For instance, a couple is getting ready to make an offer on a home listed at $1,200,000. Their representative credit score is 750 and their loan officer told them they will need a 20% down payment which results in a $240,000 cash commitment at the closing table. This, of course, is in addition to the funds needed for associated closing costs and for items such as property taxes, home insurance and prepaid interest.

When buyers come to the settlement table with $240,000+ to finance a home, they recognize they’re turning a liquid asset, or cash, into one that isn’t so liquid. Initial equity in a property in the form of a down payment typically must remain there and can only be tapped into with a home equity loan. Buyers of higher-end homes may want to hold onto their capital to be used for other things such as a retirement fund, stocks or mutual funds.

Such assets are relatively liquid and can be converted into cash rather quickly. For those who want to keep as liquid as possible and put down less at the closing table than say 20 or 30% of the sales price, there is another option that select jumbo lenders have at their disposal.

Let’s say a couple has decided they only want to make a 10% down payment on their new home purchase in Phoenix. Using this same example, that’s a minimum down payment of $120,0000. With this financing option, there really are two loans at work and not just one, a first and a second mortgage. Lenders typically refer to this option as an 80-10-10 loan or a “piggyback” mortgage. In this example, the 80 represents 80% of the sales price and the 10 equates to 10% of the sales price with the remaining 10% allotted for the down payment.

What if a borrower wants to put down even less, are there other options? There is a 95% financing option and it’s designed in a similar fashion as the 80-10-10 loan. This option requires a down payment of only 5% of the sales price and is referred to as an 80-15-5. 80% is the first mortgage, 15% is the second and 5% is the minimum down payment. And because in both scenarios there is no prepayment penalty on either loan the second can be paid off entirely over time or with a single payment. Please note the 95% option is typically limited to loan amounts below $2m as of 2024.

If this program sounds interesting to you, take some time and speak with a loan officer about the details of this structure. You’ll be expected to have at least a 700 minimum credit score and you must occupy the property as your primary residence.

Because this program is what is considered a fully documented loan you’ll be asked to provide recent bank statements, recent paycheck stubs, and W2 forms from the previous two years among other documentation. If you’re self-employed you’ll be asked to provide copies of your most recently filed federal income tax returns in lieu of check stubs and W2 forms.

Because this program is what is considered a fully documented loan you’ll be asked to provide recent bank statements, recent paycheck stubs, and W2 forms from the previous two years among other documentation. If you’re self-employed you’ll be asked to provide copies of your most recently filed federal income tax returns in lieu of check stubs and W2 forms.

If coming to the closing table with the lowest down payment possible is important to you, this mortgage program just might be the solution. These low down payment options are especially good for AZ home buyers purchasing in higher-cost locations of Phoenix, Scottsdale, Glendale, etc.

Please contact us today to learn more by calling Ph: 800-840-6449 or just submit the Quick Call Form on this page.