Jumbo Loan Center offers the latest information on low down payment Jumbo mortgages. Be sure to check the page links above for more information about the Jumbo Purchase and Refinance programs available.

Jumbo Loan Center offers the latest information on low down payment Jumbo mortgages. Be sure to check the page links above for more information about the Jumbo Purchase and Refinance programs available.

If you are a home buyer who has questions or needs assistance, please call us at Ph: 800-840-6449 or just send the Quick Call Form on this page, 7 days a week.

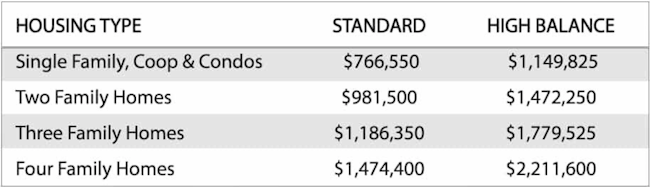

A mortgage is considered a “Jumbo” when the loan amount is greater than the conforming loan limits set by Fannie Mae and Freddie Mac. As of 2024, the conforming loan limit is $766,550 in most locations throughout the U.S. Select areas of California, Florida, Virginia, DC, Colorado, etc are deemed “high cost” and allow for conforming loan limits up to $1,149,825. Any loan amount that exceeds the conforming mortgage limit is considered a Jumbo mortgage.

Max Conforming Loan Amount for 2024:

Today select lenders and banks offer Jumbo financing options with only a 5% down payment – up to 95% loan to value. Low down payment jumbo options with 5%, 10% or 15% down are often desirable for borrowers who have their assets secured in other investments and want to retain as much cash as possible.

These programs offer a variety of secure fixed rate and adjustable rate terms with no private mortgage insurance. Please see the Jumbo Purchase page here to learn more about the latest loan qualifying and down payment requirements.

Eligible Veterans can also learn about the VA Jumbo loans on the Jumbo purchase page as well. This program is especially beneficial for Vets that require high-balance loans. 100% financing up to $2mil, higher loans up to $4m available with a limited down payment.