The real estate market in Fort Myers continues to perform well as nearly 1,000 people are moving to Florida each day. As a result, home values have remained pretty steady across the state even with the market returning to more normal levels over the last year. The current Fort Myers median home listing price sits around $372,000, and closer to $420,000 around Cape Coral.

The real estate market in Fort Myers continues to perform well as nearly 1,000 people are moving to Florida each day. As a result, home values have remained pretty steady across the state even with the market returning to more normal levels over the last year. The current Fort Myers median home listing price sits around $372,000, and closer to $420,000 around Cape Coral.

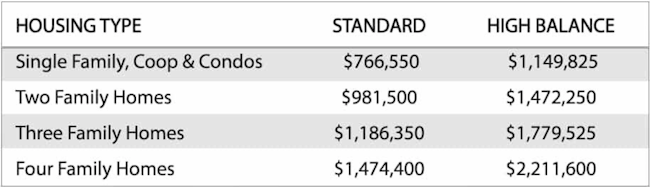

Jumbo loans remain an important financing tool as home values continue to increase. These loans apply to any mortgage that is greater than the conforming loan limit. In Lee County, the 2024 conforming loan limits are set to $766,550 for a single 1-unit property, so any loan amount greater than this would be considered a jumbo loan.

Fort Myers Jumbo Mortgage Down Payment & Loan Limits:

Jumbo loan limits are determined based on the down payment amount and credit profile of the borrower. For a maximum of 95% financing, the loan limit is generally $1.5m. For home buyers that have a 10% down payment, the loan limit increases to $2.5m. Home buyers with 15-20% have options available up to $3.5m. *Please be sure to check with us as these restrictions can change. Buyers who have questions about their purchase or refinance can call the number above, or just submit the Quick Call Form.

Jumbo Loan Qualifying Restrictions:

Just like many standard conventional loans, Jumbo loans require full documentation from the borrower. Buyers must provide income verification via W2 and/or tax returns, proof of funds for the down payment, closing costs, and payment reserves. Also, to qualify you must have a minimum credit score of 680 or higher for the max 5% down payment options. Credit score requirements are reduced for home buyers who have a greater down payment of 10% or more.

The maximum debt-to-income ratio is generally 45% of the borrower’s gross monthly income for most lenders. The DTI limits include borrowers’ monthly installment loan payments like car loans and revolving debt payments like credit cards, etc. In addition, this includes the new housing expenses of principal, interest, taxes, and homeowners insurance (PITI) This DTI limit can fluctuate slightly depending on strong compensating factors like the down payment amount, credit score, etc.

Jumbo loans are also available with no mortgage insurance (MI) even when financing less than 20% down. Many mortgage companies today use a combo piggyback loan structure to finance such loans. Typically this involves combining a first mortgage for 80% of the purchase price and adding a second loan that covers the remaining 10 or 15%. This type of structure can help borrowers avoid expensive PMI or Lender’s Mortgage Insurance (LMI) costs and improve their cash flow greatly.

The structure also allows the home buyer to often utilize lower interest rates on the primary first mortgage. Buyers can choose from traditional 30 and 15-year fixed rate loans, and also adjustable rate terms.

Your Jumbo Loan Expert:

At Jumbo Loan Center, we specialize in helping you find the right loan for your needs with low interest rates and flexible terms. Our team of experienced professionals is available to serve you 7 days a week. Please call or submit the Quick Call Form on this page.