FHA mortgages are a popular choice for homebuyers because they offer lower down payment options and have more flexible credit standards than many other mortgage loan types. FHA loan limits are capped out to around $498,257 in most locations around the U.S. This can make using the FHA program difficult for many luxury home buyers.

FHA mortgages are a popular choice for homebuyers because they offer lower down payment options and have more flexible credit standards than many other mortgage loan types. FHA loan limits are capped out to around $498,257 in most locations around the U.S. This can make using the FHA program difficult for many luxury home buyers.

However, the FHA loan amount limits are much higher in select “high cost” locations in California, South Florida, Virginia, Colorado, etc. If you are in search of a larger loan in these high-cost locations, be sure to check the FHA loan amount limits before applying for a Jumbo loan as you may be surprised. In some higher cost counties, the FHA loan limits go up to $1,149,825

FHA is a government-backed loan that is insured by the Federal Housing Association and is designed to make affordable homeownership accessible to qualified home buyers. Current homeowners who are interested in refinancing their mortgages can do so with an array of FHA loan products.

Types of FHA home loans include standard FHA purchase loans up to 96.5% financing. FHA streamline loans, which are designed to lower the interest rate and/or monthly payment of an existing FHA mortgage loan. FHA cash-out refinancing, which offers homeowners the ability to refinance their current mortgage (whether it be an FHA loan or other mortgage loan type) into an FHA loan while cashing out some of their built-up equity.

FHA LOAN BENEFITS:

- FHA loan terms have a minimum credit score requirement of just 620

- Fixed 15, 20, 25, and 30-year FHA loan terms available

- No appraisal required with an FHA Streamline refinance (must currently have an FHA loan)

- Insured by the Federal Housing Administration

- FHA loans have a minimum down payment of just 3.5%

- No pre-payment penalties if you pay your mortgage off early

- Choose from a secure fixed-rate or adjustable-rate FHA loan

- FHA Loan allows the sellers to contribute up to 6% of the purchase price towards the borrowers closing cost.

- Close in as little as 20 days with FHA loans

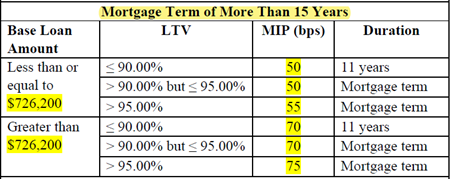

FHA loans pretty much have the same closing cost as all other loans like Conventional, etc. FHA loans have the additional cost of Up Front Mortgage Insurance Premiums (UFMIP) and monthly mortgage insurance. The Up Front Mortgage Insurance Premium (1.75%) is commonly rolled into the final loan amount. The monthly insurance premium costs will depend on the loan amount, loan term, down payment, etc. Please see the chart below.

Borrowers must fully document income and assets to be eligible for an FHA loan. In addition, FHA loans are exclusively for primary owner-occupied homes only. Vacation homes, or Investments home purchases are not eligible. Questions? Please reach out to us by submitting the Quick Call Form on this page, or call Ph: 800-840-6449