The Duluth housing market has remained robust in recent years. As a result, certain lenders are starting to relax loan qualifying requirements and allowing for reduced down payment mortgage options. Below we will take a look at the most popular Jumbo financing options for seasoned home buyers, along with many popular first-time buyer options.

The Duluth housing market has remained robust in recent years. As a result, certain lenders are starting to relax loan qualifying requirements and allowing for reduced down payment mortgage options. Below we will take a look at the most popular Jumbo financing options for seasoned home buyers, along with many popular first-time buyer options.

Jumbo Mortgage:

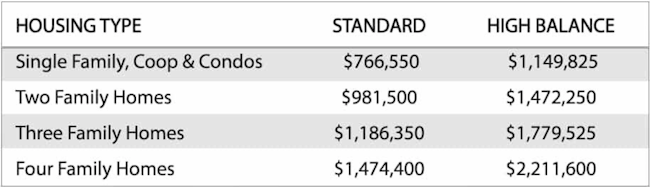

A Jumbo loan is a mortgage amount that exceeds the standard conforming loan limit. The limit for a 1-unit property in Minnesota is $766,550, so any amount that exceeds this would be “Jumbo” in nature. Until recently the down payment requirements for Jumbo were always higher from many lenders and banks. However, Jumbo loans all the way up to 95% loan to value are now available to approved buyers throughout MN including Minneapolis, St. Cloud, Saint Paul, Bloomington, etc.

These low-down-payment options will require complete income and asset documentation, along with approved credit. Furthermore, existing homeowners who want to refinance can also benefit from the higher loan values. Applicants will find the basic requirements below, please note this does apply to both Jumbo purchase and rate-term refinance transactions nationwide.

Jumbo Mortgage Requirements:

- Credit scores of 680 or above to be approved, unless the buyer is putting down more than 10% down payment. In those cases, credit scores down to 660 can be approved.

- Buyers must document with W2 and 3 months’ pay stubs. Self-employed borrowers need to provide a minimum of two years of tax returns.

- Assets will also need to be documented, this includes two months of savings, retirement account statements, etc.

- Single-family homes, townhomes and condos are eligible

- Primary Residence, vacation homes. Down payment requirements will increase to 20% when the property is an investment home purchase.

Down Payment & Loan Limits:

- 95% Loan to value, only 5% down payment: Up to $2,000,000: min 700+ credit score. Buyers can choose from a single loan up to $1,000,000 or a 1st and 2nd mortgage (80/15/5) combo up to 2.0 million. Both options do not require monthly mortgage insurance (PMI)

- 90% Loan to value, 10% down payment: Up to $3,500,000 with 720+ FICO score

- 85% Loan to value, 15% down payment: Up to $4,500,000 with 720+ FICO score

Jumbo loans are good for buyers searching for luxury homes in high-cost locations in MN. These loans are designed to simplify home buying in luxury markets by covering the full cost of the loan, so there is no need for borrowers to drain their cash savings. Similar to other mortgage programs, jumbo loans can be obtained with a standard 15 or 30-year fixed rate or adjustable rate 3/1, 5/1, 7/1, or 10/1 term. Listed below you will find some of the benefits of the Jumbo loan.

- Fast loan pre-approval process – takes only 10 min. To begin just contact us below.

- Single Family Homes, Town Homes, and approved condo-eligible

- NO origination fee on Jumbo fixed-rate or adjustable-rate mortgage home loans for purchase transactions. This significantly reduces closing costs and saves you money

- Same day loan pre-approvals, with in-house underwriting

- The convenience of one loan for the entire loan amount instead of having multiple mortgages

- Financing available up to $9,500,000

- Fix terms and adjustable rate mortgage terms available

- No monthly private mortgage insurance (PMI) option

- No prepayment or “early payoff” penalties

Please visit the Jumbo Purchase Page for more details.

Minnesota First-Time Buyer Programs:

Minnesota First-Time Buyer Programs:

FHA Mortgage:

The Federal Housing Administration (FHA) loan is sponsored by the U.S. Department of Housing and Urban Development. The buyer only has to put a 3.5 % down payment with the FHA program. The credit score and underwriting guidelines are less firm than those for a conventional loan. The buyer can put down as little as a 3.5% down payment, however, they must pay monthly private mortgage insurance. This yearly premium is typically .55% of the loan amount. Payments are broken up over 12 months.

In addition, FHA loans require a 1.75% upfront funding fee that is normally added to the buyer’s loan. FHA loans are only available to those who will occupy the property as a primary residence. Investment homes and vacation homes are not permitted. FHA remains the most popular first-time buyer program nationwide. Learn more about the FHA mortgage details here.

USDA Mortgage:

Just like FHA, the USDA mortgage is also backed by the U.S. Government. USDA loans are sponsored by the United States Department of Agriculture (USDA Rural Development) These loans are specifically reserved for more rural locations in MN. The good news most of Minnesota outside of the major metro locations like Minneapolis and Duluth are approved. Homebuyers can look up a property address on the USDA map here. The major draw is the USDA 502 program allows up to 100% financing with no down payment required. Another advantage with USDA loans is the monthly mortgage insurance is much less when compared to FHA home loans. Homebuyers can read more about USDA loan eligibility here.

VA Mortgage:

Eligible Veterans have one of the best benefits available in the 100% VA mortgage. Qualified vets can move into a home with $0 down, no PMI payments and some of the lowest interest rates available today. Put your service benefits to good use with a VA Loan and enjoy a zero down backed by the government.

Benefits of VA Loans

- A down payment is not required for VA loans

- No prepayment penalties

- No private mortgage insurance to pay each month

- Many streamline refinance and 100% cash-out options

- VA closing costs can be paid by the seller

- VA loans are assumable by qualified borrowers

- The veteran may reuse the entitlement and obtain a 2nd VA loan.

Questions? Please connect with us 7 days a week by calling the number above, or just submit the Quick Call Form on this page.

Minnesota First-Time Buyer Programs:

Minnesota First-Time Buyer Programs: