The Federal Housing Finance Agency (FHFA) recently announced the new maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2024. In most of the U.S., the 2024 maximum conforming loan limit for one-unit properties will be $766,550, up from $726,200 in 2023.

The Federal Housing Finance Agency (FHFA) recently announced the new maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2024. In most of the U.S., the 2024 maximum conforming loan limit for one-unit properties will be $766,550, up from $726,200 in 2023.

All the typical high-cost locations in CA, FLA, VA, DC, CO, etc. will see limits up to $1,149,825. This is the seventh straight year FHFA has increased the baseline loan limit. See the complete list of Conforming Loan Limits here.

This is great news for buyers as home values continue to increase. According to FHFA’s expanded-data Home Price Index, house prices increased, all across the U.S. As a result, the baseline maximum conforming loan limit in 2024 was adjusted to increase.

Home buyers that require mortgages over the standard conforming loan limit will require a Jumbo loan. Jumbo high balance loan requirements have changed recently and now permit up to 95% financing for qualified buyers. Homebuyers can learn more here about all the latest requirements on the Jumbo Purchase Page. Please contact us at the number above to learn more about all the latest jumbo financing solutions.

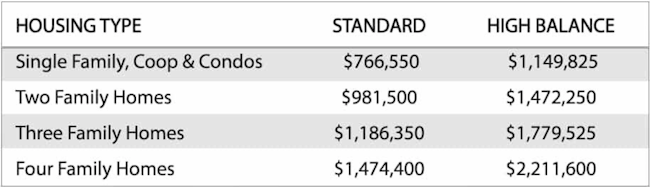

2024 Loan Limits

*FHA floor nationally is set at 65% of the conforming loan limit and can vary by county. VA limits the amount of guarantee for a zero down loan at the conforming loan limit. Jumbo VA loans above these limits require a down payment of 25% of the difference between the conforming limit and the sales price. USDA loans do not have a loan limit but limit household income.

** High-Cost limits for areas in which 115% of the local median home value exceeds the baseline conforming loan limit. The maximum limit is 150% of the conforming loan limit. Limits can be higher in Hawaii, Alaska, Guam and the U.S. Virgin Islands.

Baseline Conforming Loan Limits for 2024: